Apollo Tyres Share Price Target 2024, 2025, 2027, 2030, 2040

If you think about which share will be best for investment in recent times then you should know about Apollo Tyres Share Price Target. Today in our blog we will explain the basic idea about Apollo Tyres Share Price Target 2024, 2025, 2027, 2030, 2040. We did the research and took advice from experts to make this blog about the company’s growth, performance, etc.

Apollo Tyres Share Price Target is a trading share in the share market. In this article, we will discuss the company’s financial growth, the business policy of the company, the shareholding pattern of the company, and the forecast share price yearly. We use expert data and analysis to understand the Apollo Tyres Share Price Target. This article may be helpful to those who want to invest in this share right now. Let’s look at Apollo Tyres Share Price Target 2024 to 2040.

What Is Apollo Tyres Company?

Apollo Tyres is an Indian multinational tyre manufacturing company which was established in the year 1972. The headquarters of the company is situated in Gurgaon. In recent times the company has had five manufacturing units all over India. The company’s first manufacturing plant was established in Kerala.

Overview Of Apollo Tyres Company

For the Indian business, the company first focused on the production of truck tyres business and introduced its first truck tyre Rajdhani in India. Out of the company’s total revenue, the company generate 68% of revenue from India, 27% from Europe and 5% from other countries. In the year 2016, the company also entered into the manufacture of a two-wheeler tyre manufacture segment.

| Company Name | Apollo Tyres Limited |

| Market Cap | ₹34,989.56 Crore |

| Book Value | ₹165.45 |

| Face Value | ₹1 |

| P/B | 3.36 |

| 52 Week High | ₹558.89 |

| 52 Week Low | ₹365 |

| DIV. YIELD | 1.10% |

In the year 2015 Germany’s Reifencom tyre distributor was brought by Apollo Tyres Corporation and the company shifted its corporate office to the European region. In recent times the company has operated 2 manufacturing units in Europe one in the Netherlands and the other one in Hungary. Initially, the company manufactured 55 lakh (5.5 million) tyres per year for both business in domestic and international business.

Financial Data Analysis Of Apollo Tyres Company

Before investing any share anyone wants to see the company’s performance, overall profit, and net sales amount. We need a basic idea about the company’s PE ratio, return on assets, current ratio, and return on equity. In the below portion, we discuss the performance of the company. Apollo Tyres Share Price Target also depended upon the ratio which is described below.

| PE Ratio | Return On Assets (ROA) | Current Ratio | Return On Equity (ROE) |

| 30.30 | 5.76% | 1.14 | 11.53% |

Apollo Tyres Share Price Target History From The Year 2024 to 2040

Apollo Tyres is a bullish trend in the share market. Apollo Tyres Share is under the both Indian Stock Exchange BSE (Bombay Stock Exchange) and NSE (National Stock Exchange). In the last 6-month share price growth was +78.10 (16.56%), in the last 1-year the share growth was +133.90 (32.19%), last 5-year share growth was +375.05 (214.56%) and the maximum share growth was +543.26 (8,243.70%).

Apollo share Price Return amount was in the last 1 month -8.76%, in the last 3 months 15.27%, in the last 1-year return percentage 32.34%, in the last 3 years return amount was 138.44% and last 5 years return amount was 198.19%. Apollo Tyres company will grow more in future and the share gives good returns. If anyone wants to invest on a long-term basis it will be beneficial on a long-term basis. Let’s have a look at Apollo Tyres Share Price Target 2024 to 2040.

Apollo Tyres Share Price Target 2024

The Apollo brand is one of the most famous choices of tyres for global and Indian automobile equipment. The company’s products include car tyres, tyres for agricultural and industrial applications and bicycle tyres. The company had 1,530 Apollo quick services centres in the financial year 2022 which increased by more than 50% to the year 2021. Some of the tyre brands of Apollo Tyres are Apollo Apterra HT which is a durable tyres that deliver a steering response and vehicle control, Apollo Apterra HP which improves dry braking, and Apollo Amazer XP Car Tyres which is fuel efficient and eco-friendly.

| Year | Apollo Tyres Share Price Target 2024 |

| 1st Price Target | 480 |

| 2nd Price Target | 610 |

In the third quarter result of the financial year 2022 revenue from operations increased by 14% and the total revenue of the company (April-December) quarter in the year 2022 also increased19%. The total revenue amount was ₹15,456.89 Crore in the year 2022, March which was increased ₹18,789.89 Crore in the year 2023, March. Total operating revenue in the year 2022, March was ₹15,456.89 Crore which was increased ₹18,796.89 Crore in the year 2023, March. If we look at the share price forecast of Apollo Tyres Share Price Target 2024 the 1st Price Target is ₹480 and the 2nd Price Target is ₹610.

Also Read- Vedanta Share Price Target

Apollo Tyres Share Price 2025

In Europe, the Apollo Tyres Company has approximately 7000 dealers, has 11 European Sales offices with local distribution the company also aims for the future expansion of business in 6 other countries and to build up 38 stores in Germany. The company gives an important look at R&D fields. The company established R&D Centers in Asia and Europe and has more than 430 scientists for research purposes. In the financial year 2021, the company’s R&D expenditure amount was ₹3,349 Crore and in the year 2023, the amount was ₹3,345 Crore.

| Year | Apollo Tyres Share Price Target 2025 |

| 1st Price Target | 650 |

| 2nd Price Target | 820 |

In the last 1 year, the profit amount of the company increased a huge amount. In the last 5 years, the profit amount was -1.45%, in the last 3 years it became 4.6% and in the last 1 year it became 121.23%. The net profit amount was ₹260.56 Crore in 2022, March which became ₹579.56 Crore in 2023, March. The operating profit amount was ₹13,325.56 Crore in 2022, March which became ₹15,789.56 Crore in 2023, March. If we look at the share price forecast of Apollo Tyres Share Price Target 2025, the 1st Price Target is ₹650 and the 2nd Price Target is ₹820.

Apollo Tyres Share Price Target 2027

The company has 200 patient fields in tyre technology globally. In the financial year 2022, the revenue from commercial vehicles was 64%, from passenger vehicles 22%, from two-wheelers 1%, from off-highway vehicles was 9% and revenue from other vehicles was 2%. One of the newly launched products by the company in the Indian market is Vredestin. The company has an important role in agriculture fields. Some of the innovative models are The Apollo FX 222, The Apollo FX 212 etc.

| Year | Apollo Tyres Share Price Target 2027 |

| 1st Price Target | 1110 |

| 2nd Price Target | 1320 |

The sales amount of the company also increases. The last 5 year’s sales amount was 11.2% which became 17.2% in the last 3 years and the last year’s sales percentage was 19.2%. The net sales amount was ₹14,789.56 Crore in 2022, March which became ₹17,456.23 Crore in 2023, March. The EBITDA amount was ₹27,892 Crore in 2022 and in 2023 the amount was ₹25,456 Crore. If we look at the share price forecast of Apollo Tyres Share Price Target 2027, the 1st Price Target is ₹1110 and the 2nd Price Target is ₹1320.

Apollo Tyres Share Price Target 2030

Apollo Tyres Company gives an important outlook on information technology. To obtain more profit the company’s main objective is to connect its supply chain of 170 distribution centres, 19 regional distribution centres and 7 factories with the help of digital technology. In the passenger car segment, the most demanding product of the company is the Aspire 4G Luxury model (like Apollo Alnac 4G) which offers better mileage and ride comfort. Some of the industrial uses models are ALT 118, ALT 618, AMP 118, etc which are used in the sector of construction, mining and many other industries.

| Year | Apollo Tyres Share Price Target 2030 |

| 1st Price Target | 1920 |

| 2nd Price Target | 2110 |

As the company spreads its business in Eupore-based countries also the FII investors of the company is high which is 17% to 18% which is a very progressive part foe the company’s growth. As the company is a very old company and has good market demand the promoter holding capacity of the company is good which is 38.15% which means many good investors want to invest in the share. If we look at the share price forecast of Apollo Tyres Share Target 2030, the 1st Price Target is ₹1920 and the 2nd Price Target is ₹2110.

Apollo Tyres Share Price Target 2040

During the COVID-19 pandemic time, the cost of raw materials increased by up to 30%. The crude-based raw materials Synthetic Rubber, Nylon, and Polyester Fabric increased in a high range. In the field of scooters and bikes, some of the models like ActiGRIP, ActiZIP, Alpha Series and the newly launched Apollo Tramplr motorcycle tyres are the most performed vehicles. Through solid waste management, the company gained more than 5 lakh benefits from all projects. The company has a 30% market share in the commercial vehicles segment and has 20% market share in the passenger vehicles segment.

| Year | Apollo Tyres Share Price Target 2040 |

| 1st Price Target | 3760 |

| 2nd Price Target | 4010 |

The ROE percentage was 6.12% in the last 3 years which increased to 6.90% in the last 1 year. The total expenditure amount was ₹14,789.56 Crore in the year 2022, March which became ₹17,890.56 Crore in 2023, March. The Tax amount was ₹90.12 Crore in March 2022 which became ₹234.12 Crore in 2023, March. If we look at the share price forecast of Apollo Tyres Share Price Target 2040 the 1st Price Target is ₹3760 and the 2nd Price Target is ₹4010.

Also Read- NALCO Share Price Target

How To Purchase Apollo Tyres Share?

The most common trading platform for purchasing the Apollo Tyres Share is described below.

- Zerodha

- Upstox

- Groww

- Angelone

Peer’s Company of Apollo Tyres Company

- Bridgestone Crop

- Continental AG

- The Goodyear Tire & Rubber Co

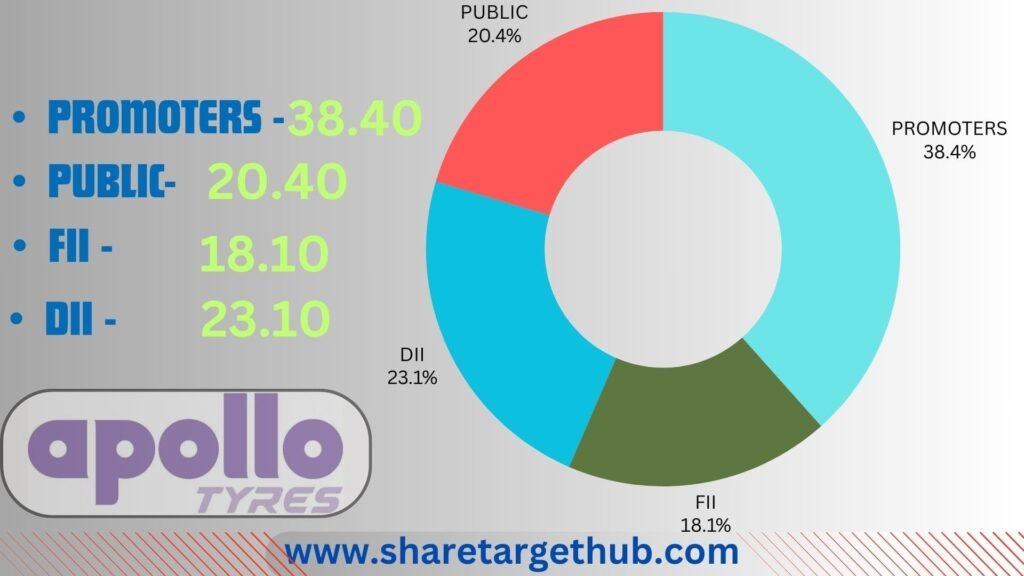

Investors Types And Ratio Of Apollo Tyres Company

There are mainly four Types of Investors in Apollo Tyres Company. The company’s growth also depended upon the ratio of investors who invested in the share.

Promoters Holding

Promoters Holding means how much capital is invested by company promoters (owner of the company) through overall capital. Apollo Tyres Company’s promoter holding capacity is 38.40%.

Public Holding

Public Investors are individuals who invest in the public market for profit in the future (large and small companies). Apollo Tyres Company’s public holding capacity is 20.40%.

FII

Foreign Institutional Investors are those big companies that invest in different countries company. Apollo Tyres Company’s FII is 18.10%.

DII

Domestic Institutional Investors (like Insurance, companies mutual funds) who invest in their own country. Apollo Tyres Company’s DII is 23.10%.

Advantages and Disadvantages Of Apollo Tyres Share

Every share has some advantages and some disadvantages also. So, the Apollo Tyres Share Price Target also has some advantages and disadvantages described below.

Advantages

- In the last financial year 2022, the revenue of the company increased 19%.

- Last year’s profit growth of the company was 121.23%.

- The company has an efficient cash conversation cycle which is 1.74 days.

- The company has good cash flow management PAT stands at 2.69.

- The company is growing with a small amount of debt.

- The book value amount increased in the last 2 years.

Disadvantages

- The company has a poor ROE which is 6.12% in the last 3 years.

- The cash generation amount from the core business was low.

Also Read- Hindalco Share Price Target

FAQ

Should I invest in Apollo Tyres Share Price Target right now?

The share growth of the company was 119.21% in the last 5 years and the share price return amount was 110.19% in the last 3 years. As the brand of a different tyre manufacturing company, the company has good market condition. The company also spread its business outside of India. Apollo Tyres Share always gives good returns to investors if anyone wants to invest it will be beneficial.

What is the future growth of Apollo Tyres company?

Apollo Tyres company grew with a revenue of 19% in the last financial year. The company’s last year’s sales rate increased by 19.2%. The company always try to improve the product’s demand with the help of the R&D team and tries to innovate new products. The product demand of the company also increasing in the USA. The company has a growing future in the coming year.

Who is the chairman of Apollo Tyres Company?

Mr. Onkar Kanwar is the chairman of Apollo Tyres company.

Which Country’s brand is Apollo Tyres?

Apollo Tyres Company is One of the top most company in 20 tyre companies the headquarters of the company is situated in Gurgaon.

Who is the CEO of Apollo Tyres Company?

Mr Prathap C Reddy is the CEO of Apollo Tyres Company.

How many plants are in Apollo Tyres?

The company has six plants in overall India and abroad also.

What is the Apollo Tyres Share Price Target for the year 2024?

Apollo Tyres Share Price Target for the year 2024 is ₹480 to ₹610.

What is the Apollo Tyres Share Price Target for the year 2025?

Apollo Tyres Share Price Target for the year 2025 is ₹650 to ₹820.

What is the Apollo Tyres Share Price Target for the year 2027?

Apollo Tyres Share Price Target for the year 2027 is ₹1110 to ₹1320.

What is the Apollo Tyres Share Price Target for the year 2028?

Apollo Tyres Share Price Target for the year 2028 is ₹1425 to ₹1560.

What is the Apollo Tyres Share Price Target for the year 2030?

Apollo Tyres Share Price Target for the year 2030 is ₹1920 to ₹2110.

What is the Apollo Tyres Share Price Target for the year 2035?

Apollo Tyres Share Price Target for the year 2035 is ₹2810 to ₹3000.

What is the Apollo Tyres Share Price Target for the year 2040?

Apollo Tyres Share Price Target for the year 2040 is ₹3760 to ₹4010.

Conclusion

Hopefully, www.sharetargethub.com will help you gain some basic ideas about the Apollo Tyres Share Price Target. By doing the research and taking advice from expertise we ensure that on a long-term basis, Apollo Tyres Share Price Target may reach a very high position. Apollo Tyres Company is related to the multinational tyre manufacturing sectors. So the demand for this sector also increases which helps the share to gain profit in the future.

If you think this website will be helpful for you then you can share it. If you have any questions please let us know through the comment box we will try to reply to your questions and solve your problem. Thanks for visiting this website and thanks for being with us.

Disclaimer – We are not SEBI-registered advisors. A financial market is always risky to anyone. This website is only for training and educational purposes. So before investing, we are requested to discuss certified expertise. We will not be responsible for anyone’s profit or loss.